are assisted living expenses tax deductible in 2021

Are Assisted Living Expenses Tax Deductible In 2021 In the case of an assisted living community your loved one or an appropriate relative may qualify for a medical. As a part of the placement process at the facility it was determined that he needed to be restricted to the memory care unit where he now lives full time.

Is Your Parent Moving Into A Nursing Home Soon Take Advantage Of These 5 Tax Saving Tips Wegner Cpas

Expenses you cannot claim You cannot claim the cost of any of the following.

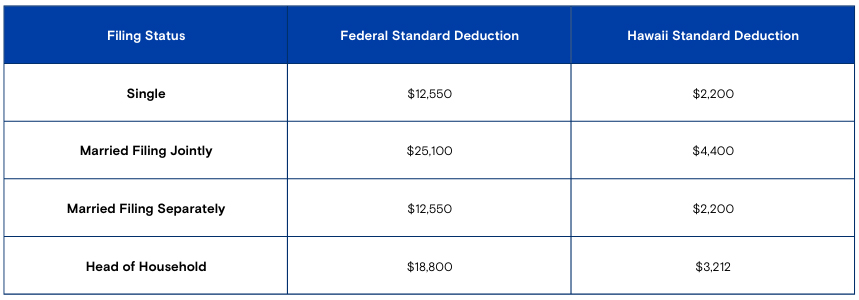

. Assisted living expenses are deductible when a doctor has certified a patient cant care for themselves. Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes and you can only claim care expenses that you paid. The standard deductionwhich is claimed by the vast majority of taxpayerswill increase by 800 for married couples filing jointly going from 25100 for 2021 to 25900 for.

Assisted living facilities and care workers provide additional help for seniors to live independently in a safe environment. If you your spouse or your dependent is in a nursing home primarily for medical. A lot of the aforementioned expenses could be incurred whether the person is being cared for in a.

Answer Yes in certain instances nursing home expenses are deductible medical expenses. Are assisted living expenses tax deductible in 2021. Yes if you live in an assisted living facility you can.

There are several other legal changes for the 2021 tax year including. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. Other Things to Keep in Mind In order to claim.

In order for assisted. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Paying for assisted living can be expensive so.

Initiation or entrance fees related to medical care or assisted living. The available credit has increased from 1050 to 4000 for one qualifying dependent and from. Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes.

The cost of your prescription. However you can only claim medical expenses that you. IN 2021 THAT LIMIT WAS SET AT 4300 but it typically does not include income they may receive from Social Security.

Here are a few items that you can deduct from your taxes in association with your assisted living expenses that cover your medical expenses. Can You Write Off Assisted Living On Your Taxes. Rent except the part of rent for services that help a person with daily tasks such as laundry and housekeeping.

These individuals are unable to perform. In preparation for his. Meals and lodging wouldnt be deductible.

100 Meals Deduction For 2021 And 2022 Ketel Thorstenson Llp

Can You Claim A Tax Deduction For Assisted Living The Arbors

Is Senior Home Care Tax Deductible

Are There Tax Deductions For Senior Living Expenses

How To Save Money On Assisted Living Costs I A Place For Mom

How To Get Into Independent Living On A Budget Boomershub Blog

:max_bytes(150000):strip_icc()/Investopedia_Stayinghomevsmovingtoretirementcommunity_colorv1-15aa3217ee2a4315a572e2eab94b0074.png)

Senior Care Planning For The Future

Trusted Guide To Travel Nurse Taxes Trusted Health

Is Audit Defense Tax Deductible

:max_bytes(150000):strip_icc()/Nursing-Home-Costs-What-You-Need-to-Know-GettyImages-755651237-2-2000-75635c540bd4464f8c92a30ebe7f4399.jpg)

What A Nursing Home Costs In 2021 And How To Be Prepared

Collecting Fair Market Rent Is Vital To Tax Deductions Incompass Tax Estate And Business Solutions Sacramento

Can I Deduct Senior Living Expenses From My Taxes

Dependent Tax Deductions And Credits For Families Turbotax Tax Tips Videos

New Federal Bill Could Allow Tax Deduction For Surrogacy Expenses

Is Assisted Living Tax Deductible Medicare Life Health

2021 Tax Benefit Amounts For Long Term Care Insurance Announced By Irs Ltc News

How To Record Tax Deductions For My Mother S Nursing Home Expenses

Tax Credits Vs Tax Deductions Making The Most Of Your Tax Benefits Bank Of Hawaii

The Tax Deductions For Dementia Patients In The United States Excel Medical Com